A positive month at last! Maven is in the recovery.

It has been some very exhausting (both in energy and money) past months, and finally things are starting to settle down. I am able to go back to routine and strike balance in my life.

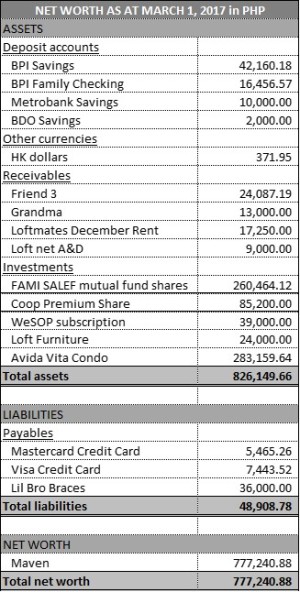

The Balance

The Breakdown

Though my cash balance has dwindled down a bit, my payables have significantly dropped from settling my credit cards especially with the tuition fees and Singapore splurges already paid out.

Aside from that I actually paid out my life insurance policy‘s 4th year premium last month too. So come to think of it, my decrease in cash is relatively small compared to all my cash outflows for this month.

This is because my corporate slavery has paid off again – literally. HAHA. In this month’s payroll, I received a retroactive salary adjustment for a 10% increase due to my change in role which was effective January 1st. Also, I received a Php10,000.00 cash reward for high performance from last year. Of course I didn’t really get all these much because taxes. *Sigh* But still, I’m glad to be appraised in the company I’m working for.

Also an achievement this month is that I opened another bank account! Hahaha. My first savings account with BDO – a bank that I actually hate because really, they are not finding ways, but still, they are currently the largest bank in the Philippines and there are definitely perks being with them. As for me, it is primarily because I have a corporate Amex credit card that I need to pay through BDO. Since I’ll be travelling a bit, I will most likely use it frequently so might as well make it easy for me by having a savings account with them and be able to pay online. Opening bank accounts is also a strategy for me to build my emergency cash funds. Hehe. It’s like tricking myself again to stash money because I need to maintain the minimum balances. Though right now I just put in the minimum balance of Php2,000.00, I plan to grow it too and make it a place where I can put my extra income from working as a SunLife Financial Advisor and my dividends from our company COOP.

I realized my investments have been growing by around Php30,000.00 a month these past three months. Good job to me! I didn’t even realize that. Hope I could keep this up and ensure my net worth’s stable for the rest of the year.

I’m already excited for my next update on April 1st because it’s BONUS PAYOUT TIME! I know, do not count the eggs before they hatch. Or something like that. But how can I not? I’m a finance nerd. Hihi.

P30,000 a month? Can you help me how to achieve this? Much love.

LikeLike

Hey, Mel! I’m sure you can do this too. 🙂 To start, of course it will only be possible if you increase your cash inflow or income. Then the rest is really just trying to automate your savings and investments.

As for me, the P30k a month is P15k for paying my condo, P7.8k for my company’s share options, and P7.1k for my share premium in our employee COOP. The first one is paid out through postdated checks, and the other two from salary deductions. So in reality, what I just do is fund the checking account and wait that the others get deducted from my salary. Minimal effort in total. 😛

LikeLike

Lets see I also have multiple accounts at BPI, BDO, & last January I opened my first Security Bank account. Initially I wanted a Metrobank account but went for SB instead which is great I have no complains so far including da interest rate 😆

As for insurance Im really lucky that my parents got me one & completely paid for it.

Congrats on da growing investments, bonus pay out dis April, 10% increase on pay, & 10K cash reward for last year’s performance. Didnt I just tell u that God will surely bless you? haha.

LikeLike

Oh! How good is SB’s interest rate? 😀 Or maybe it’s because you fall in a higher tier already? Haha.

Yeah, hard work really pays off. 🙂 Thanks for reminding me that, and that I should always be grateful for His blessings. 0:)

LikeLike

Yep I placed 1 Million in a Time Deposit at 2%. I consider this as an investment & not one of the 2 rainy day funds since I wont have access to it for a year otherwise I’ll be penalize for it.

I agree hardwork & discipline really pays off in the end.

LikeLike

Sabi ko na nga ba eh! Kaw na! Haha. That’s good na nga and sure returns naman ‘yan. 🙂

LikeLike

True. I actually started with Time Deposits a decade ago I hav 3 total then da rest are investments. I need a very large security blanket kc LOL so 2 huge rainy day funds plus 3 time deposits ang kinalabasan. Different strokes for different folks sabi nga di ba so gawin mo kung ano sa tingin mo ang para sayo.

LikeLike

Noted. 🙂 I have a curious question if you don’t mind and just in case you know. Does the PDIC guarantee also apply to time deposits? And if yes, is it still for just P500,000?

LikeLike

I know 😊 Yes you are correct only guarantees 500K per deposit. But for a major bank to fail it’s unlikely to happen though it’s possible. I understand ur concern even have close friends talk 2 me about it. Im not worried at all not one bit. All hav risks nman even investments the important thing is that ur aware & understand what it means for u. I have NO plans of adding Time Deposit or cash reserves anymore. Tama na yung 5 accounts for me (3 Time Deposits & 2 savings). Yan lng kc yung inuna ko 2 be comfortable investing heavily in stocks & mutual funds. I sometimes move da funds around like what I did with my money in Security Bank to get a better interest rate. Besides when I started a decade ago dun ako sa pinaka kilala nag umpisa…savings account & Time Deposits. In other words old money na yung nsa 5 accounts ko.

LikeLike

Thanks for the clarification. 🙂 I pondered on that a lot before because my Aunt lost a lot of money when Export Bank closed down. But yeah, it was a small bank compared to the others. And the reputation and history of doing business also matters a lot whether it is acceptable to take risks or not with banks.

I know the need for security; it’s the same feeling with me when balancing the money I put into the condo I’m paying for vs. in mutual funds. Kahit tangible kasi ‘yung condo, super illiquid nya. So really depends on a lot of factors.

LikeLike

I actually know a friend who was using ExportBank (payroll) that time luckily he got his money back. It may seem like I’m missing a lot by parking huge amount of money on 3 Time Deposits & 2 Savings Account but you cant really put a price tag on peace of mind. I dont think BPI & BDO will be going anywhere. As for Security Bank I might withdraw the 500K once it matures then deposit it to MetroBank. Hahaha biglang natakot sa cnabi mo. I actually thought of buying a condo 2 years ago but had no time to shop around. It didn’t help that there are so many na overwhelm ako sa dami ng choices LOL.

LikeLiked by 1 person

Hahaha! Sorry if I scared you. XD Pero okay lang ‘yan, the more bank accounts the better(?). Parang diversification lang din; at least spread out to different institutions ‘yung money mo. 🙂

Ako rin ganyan dun sa condo! Haha. Basta sabi ko, dapat known developer; same lang din nung concept sa banks. 😉 Tapos ayun, nadaan lang sa kulit ng agent ko and napakuha na rin. :))

LikeLike

True about Diversification. I guess that’s the reason why I didnt invest in UITFs kc thru banks na nman. I have mutual funds & directly invest in stocks. When it comes to real estate I’m not in a hurry. My parents already gave me a house so I’ll be living there in a few years. Cant right now since my apartment is located 10 minutes from my workplace. When I get a condo will probably have it rented since I know that I’m not the condo type haha. & YES you scared me big-time LOL.

LikeLike

Haha! I am sorry! I didn’t mean to but I guess that’s the point of my blog. I just really want to share what I know with everyone. 🙂

I’m planning to start directly investing in stocks this year too! Please give me advice once I get on it. 😀 And maybe when I get my condo and start renting it out, I can also share my experiences with you. 🙂

LikeLike

Sharing is caring sabi nga so it’s more than okay. Sure would love to give u tips. I started with mutual funds first because back then I wasnt confident picking stocks on my own dat’s what a Fund Manager is for nga. After getting my feet wet for a year & constantly reading I finally went for it. Iba kc fulfillment if ur da one directly investing/trading then you make money (lots…if lucky) of it ang saya saya seriously. Tapos nkikita mo dat ur networth is growing. Like you I used to compute my networth every year when I was in my 20s but now in my 30s I just do it every end of da year mas exciting kc u see that what u worked for grows exponentially.

Then u can share with me ur condo experiences 😅 Lets swap stories.

LikeLike

[…] I have forecast last month, I have hit the million milestone today in terms of net worth. Here’s the […]

LikeLike