Hello blogging world!

I’ve been buried in work and other activities lately that I’ve missed to write again about a lot of stuff that’s been in my mind for this blog. But let me restart the momentum by sharing with you how my first COL investment portfolio looks like!

Having a direct stock investment account with COL has been my goal for quite a while now, and joining last April’s The Global Filipino Investor’s Financial Literacy Summit has finally enabled me to do it. There were representatives from COL so H and I had filled out forms and opened our own accounts! I won’t go into the details of doing such since I believe you can find tons of articles explaining it already (click here or here), but what I want to share with you here is how I started funding my COL account and picking my first stocks!

Disclaimer: I haven’t attended any of the free seminars they offer and this sharing is based on personal experience.

-

Fund your COL Financial account

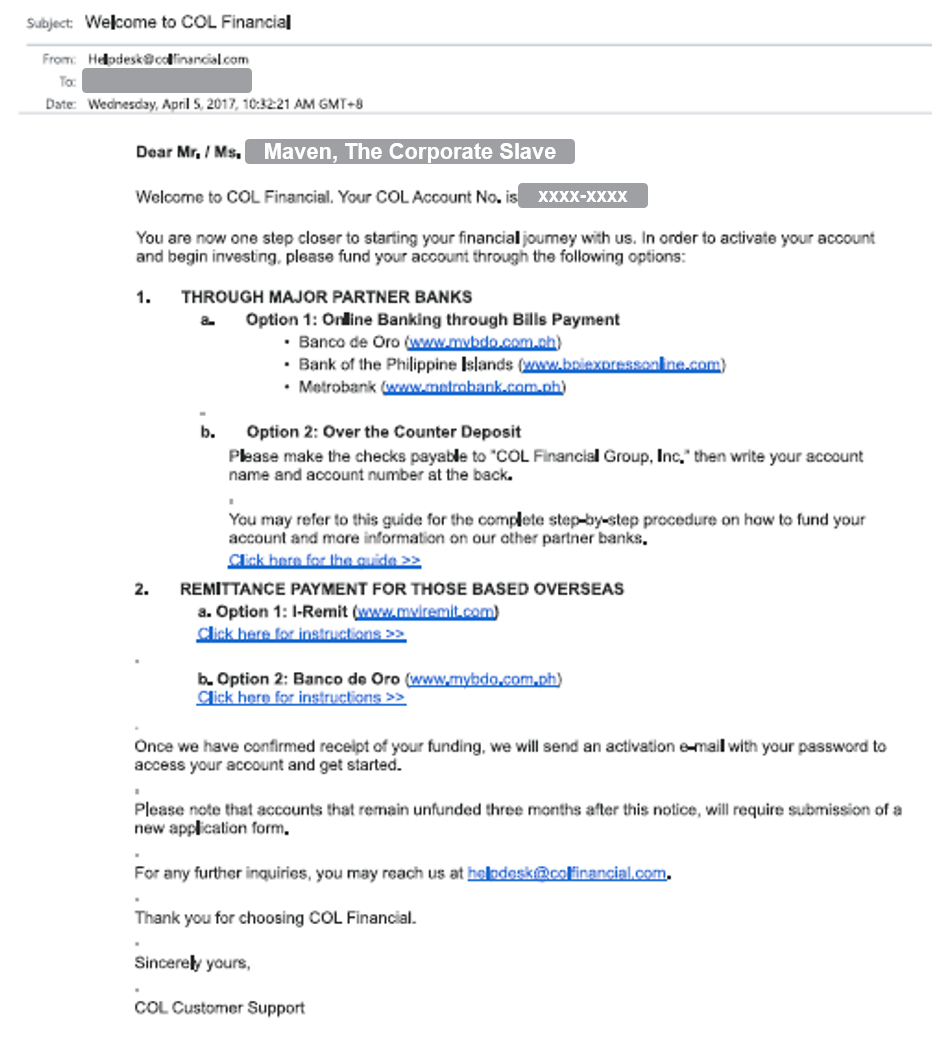

Once you have completed the application, COL Financial will email you a confirmation and instructions on how to activate your account by funding it.

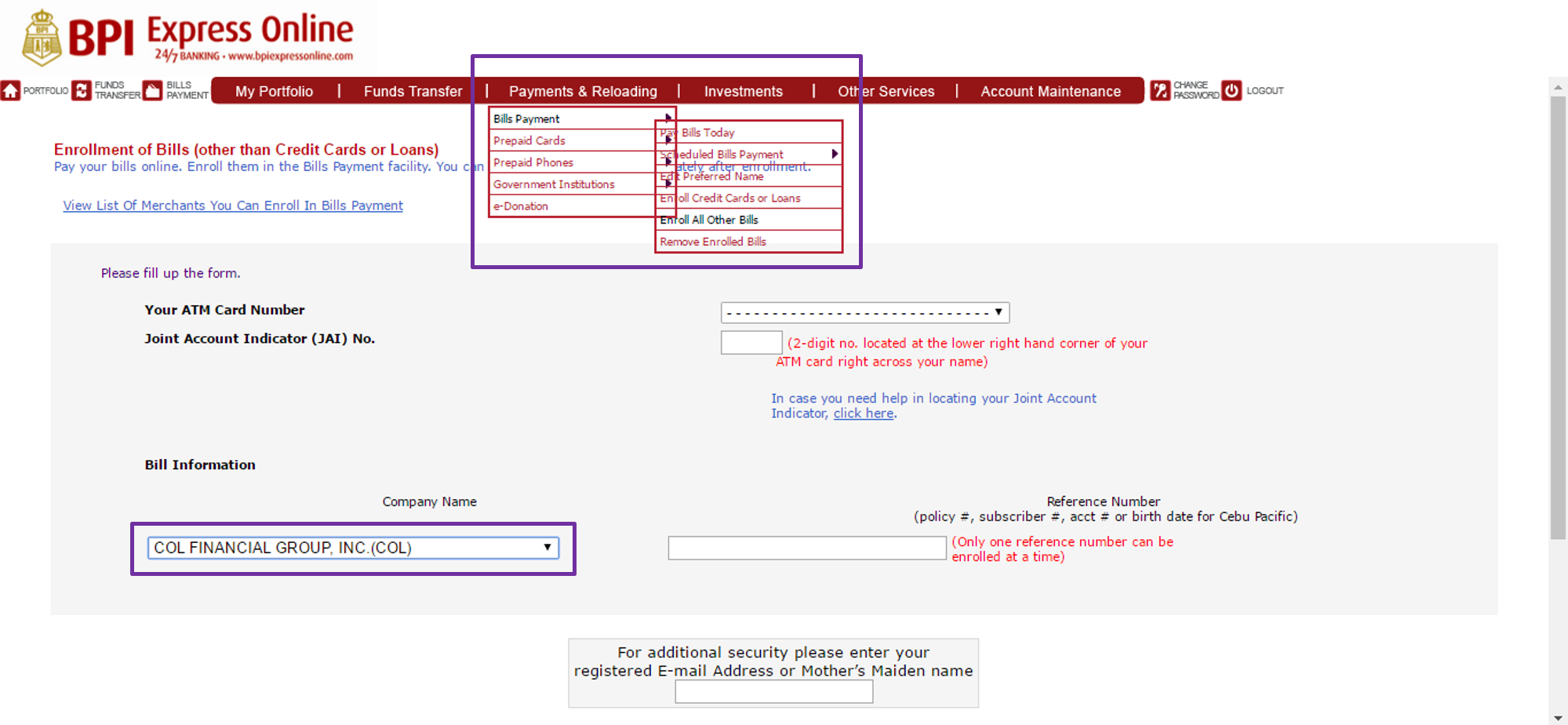

I’m banking with BPI so I simply enrolled COL online and paid Php25,000.00. You can also start with their Php10,000.00 minimum investment plan. I think the only difference is with regards to the platform that would be made available to you initially but as your portfolio grows, they will also automatically upgrade your plan.

In my case, COL confirmed my payment and sent my password after one business day.

2. Login to your COL Financial account

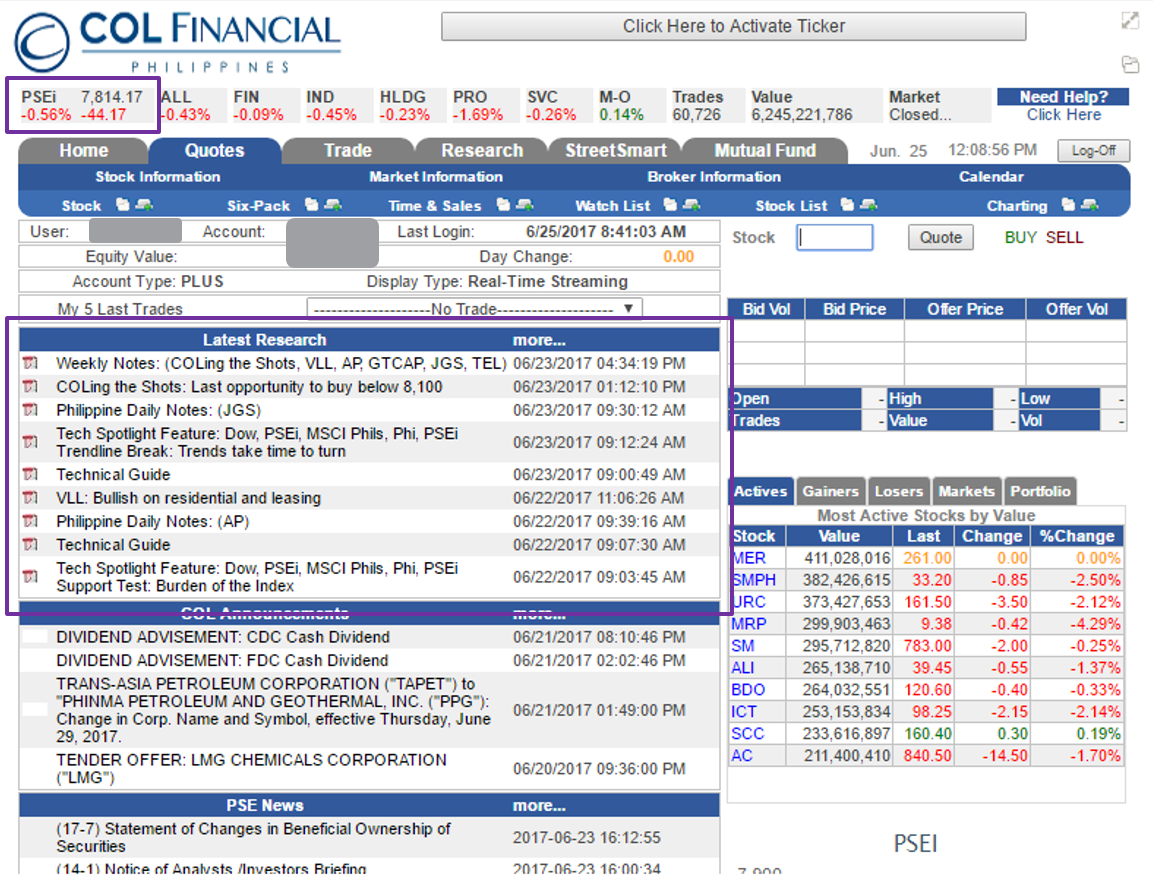

It’s now time to login to your COL account. Go to colfinancial.com and enter your details.

Here is the screenshot of my current dashboard. You can quickly check the market’s performance from the stats above for: the whole index – PSEi, and the segments for Financials, Industrial, Holding Firms, Property, Services, and Mining and Oil.

Before you get into it, research is an important step towards investing wisely, so I suggest you also read a bit on the reports made available to you by COL. This is actually one of the useful services they offer in turn for the costs they charge for every transaction.

3. Buy your first stocks.

Again, this is based on personal experience so please proceed with caution in following the strategy I’m sharing. Investing in stocks is risky so be sure you are ready for it!

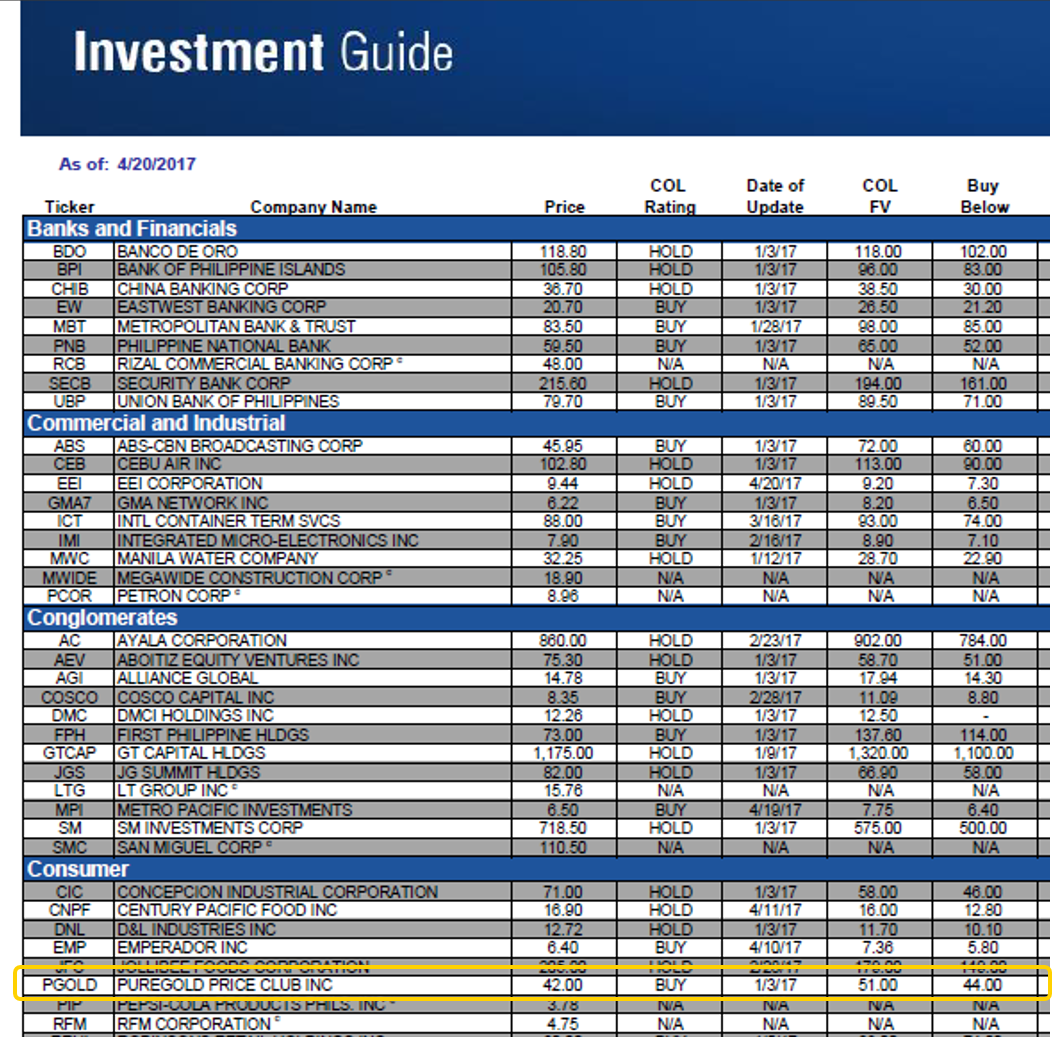

As I explored the site, I found this useful investment guide from their research section. Generally, people buy stocks 1) for trading or 2) for long-term investing. I’m more for the latter and because of this, I feel that fundamental analysis is a better strategy for me. Fundamental analysis values the company in a holistic way and estimates its future performance, ultimately enabling investors to determine whether it’s good to buy, hold, or sell the company’s stocks based on its current price and its estimated value. Technical analysis is geared more towards traders who study the movement and trends in the stock prices and take profits in the short run from fluctuations in the market.

Phew. That was a lot of words. That’s just actually my own definition. I hope I could give you a simpler way to explain the concept, but let’s just try to see first what I tried to do…

Basically, the investment guide is a summary of all the companies that COL has studied over a period of time, and contains their rating whether it is good to buy, hold, or sell a stock. In above, you can see the current price, COL rating, date as of update, COL FV, and buy below statistics.

Let’s take one of my most profitable stocks as of the moment PGOLD:PM or Puregold Price Club Inc as an example. I’m pretty sure everyone knows about them from the numerous grocery stores they opened nationwide. In above’s report, it’s current price is Php42.00 a share while COL’s valuation is at Php51.00! Imagine the Php9.00 discount, multiplied by how many shares you can buy at this rate. Get what I mean? So if you have Php4,200.00 and bought 100 shares, you can potentially gain Php900.00. What if you had Php42,000.00 and bought 1000 shares? Then you’d gain Php9,000.00!

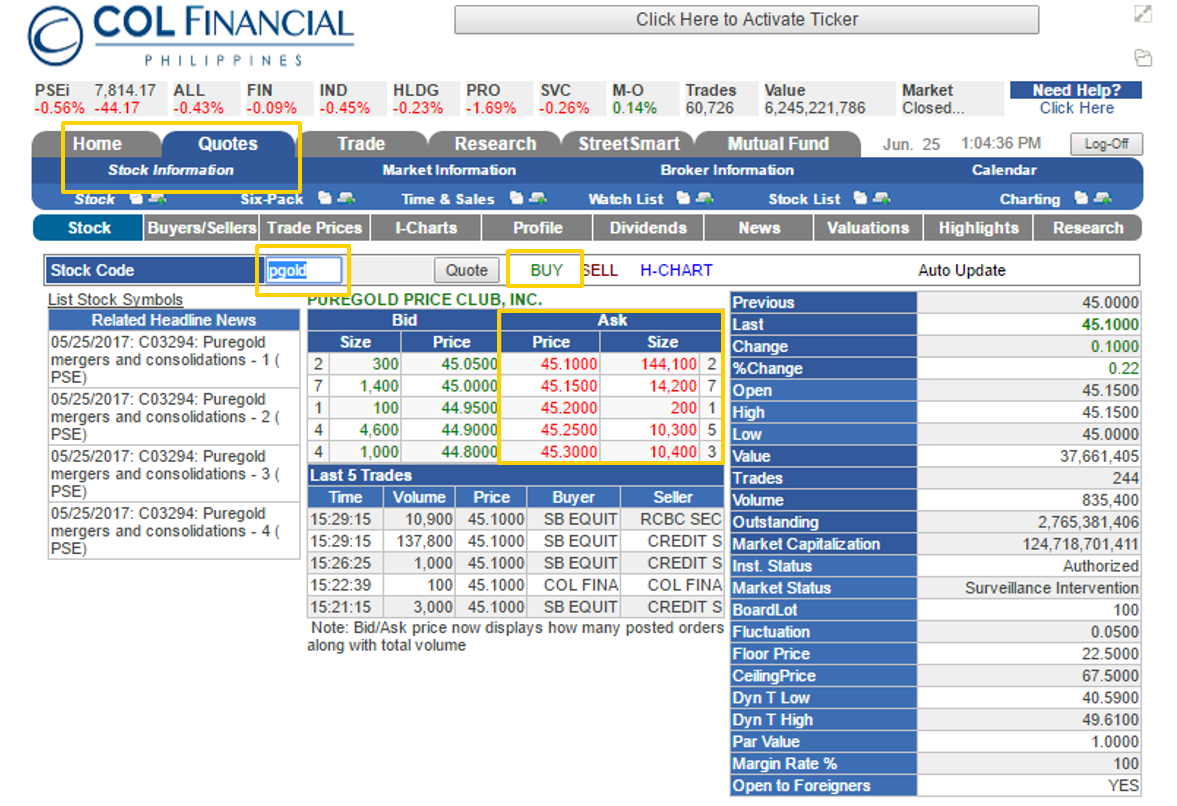

Here’s how you can check and buy PGOLD today:

Of course profiting from this is not that easy and not 100% sure, but with the right approach and knowing the companies well, you can succeed with this strategy of buying low, and selling high. As I’m disclosing to you next, my PGOLD investment was favorable but most other stocks still need some time to bear fruit:

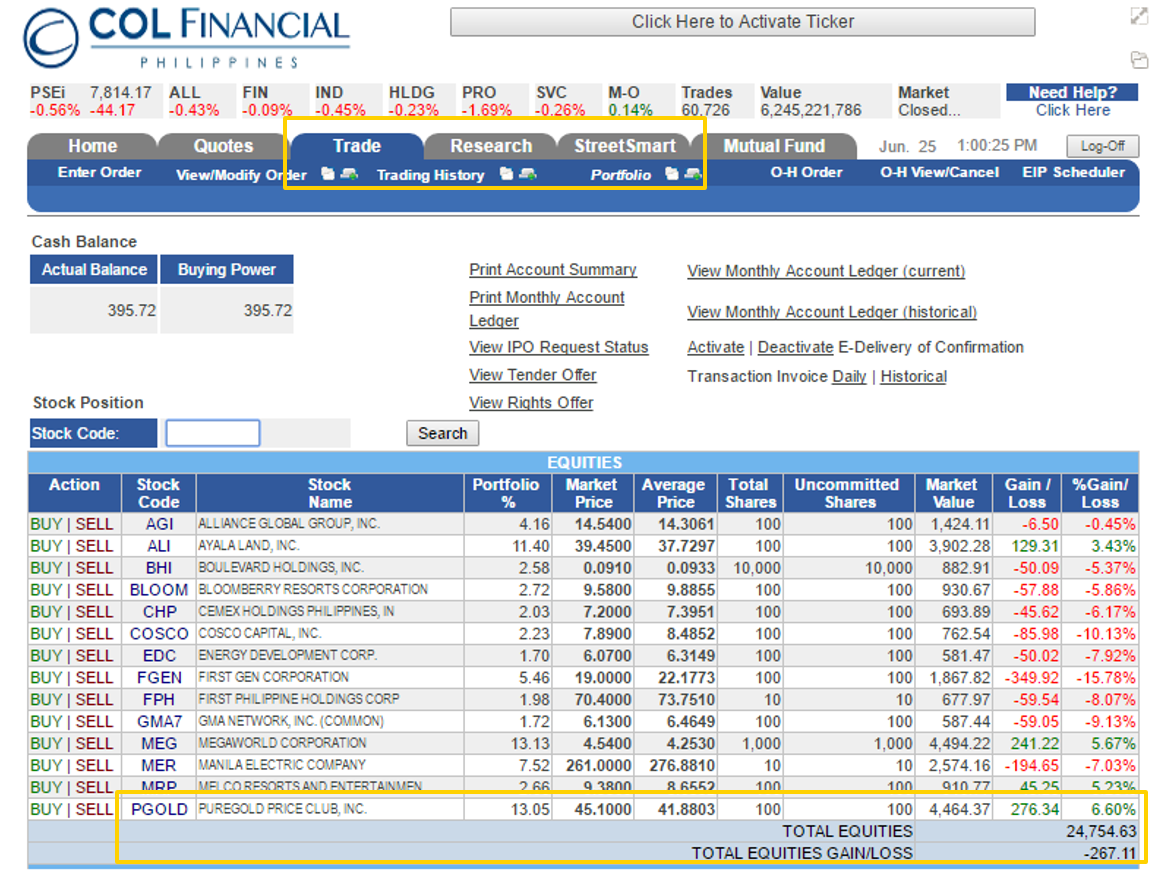

Tada! As you can see, in total, I have only 4 companies that are currently gaining: ALI, MEG, MRP, and PGOLD. But these are good companies that I would really love to hold onto for good and was fortunate enough to buy cheap. The rest are on a decline but very minimally and my total net loss so far is just Php-267.11. This might also just be temporary because the whole market is down. A few weeks ago when the index was at the 8,000 level, I was already at a net gain.

Conclusion

As with anything, investing takes time and knowledge. You’ll be extremely lucky if you gain during the first few times of doing this. But what’s important is that you TRY. Postponing investing only costs you time that you will never earn back. So better start now!

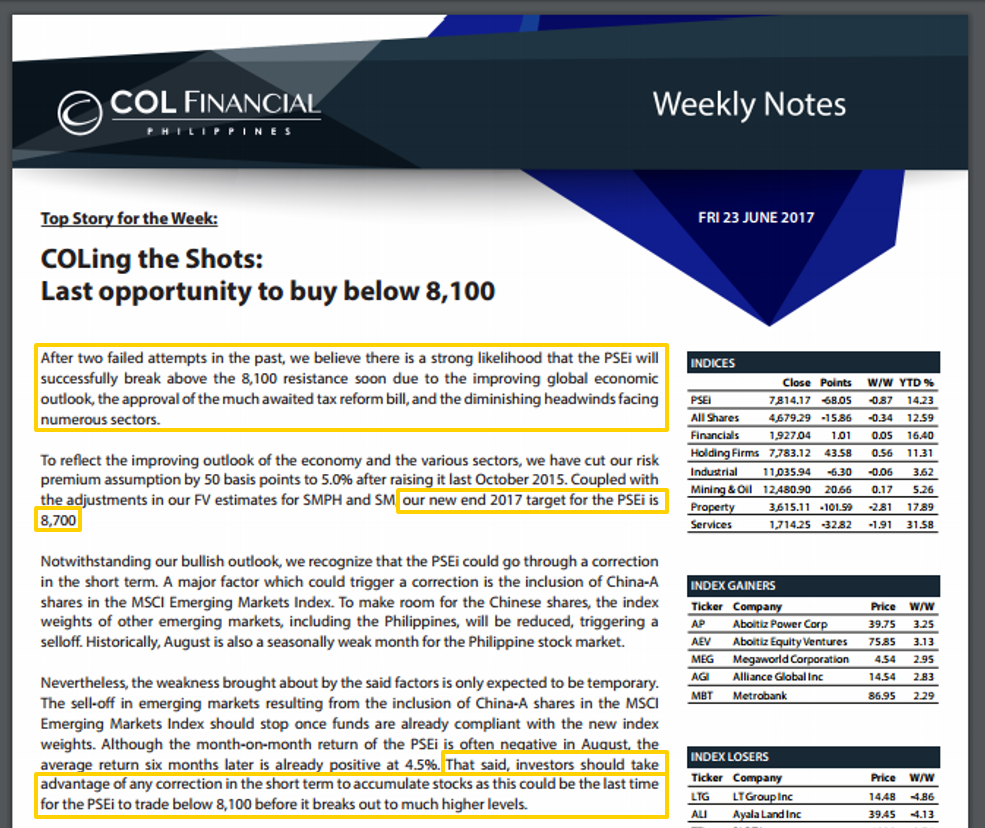

I’ll leave you with a final report from COL on their perspective on where the market will go to in the next months. Hopefully, this seals the deal for you to start investing now! 😉

Cheerios,

Maven

P. S. This is not a sponsored post. I’d also really like to thank COL Financial for being a tool to help Filipinos invest over the years and for guiding newbies like me into starting.

Update as of 2020: So I haven’t really been mindful of transaction fees when I started. XD And I made the mistake of diversifying too much, I might have been better off just going for an index fund. :)) Now that I know a bit more, please check out my updated video series on how to use COL Financial here. Good luck!

Hi Maven, It’s me again 😀 Im surprised you have that many stocks for 25K. I only have a million pesos in COL (coz I have others accounts in other brokerage firms too…you know diversification) but you still have more stocks than me haha. Happy investing 😊 & I agree that it takes time. You’re not supposed to touch your investments unless it’s an absolute emergency which is why a rainy fund is really a must have before anything else.

LikeLiked by 1 person

Hi Francis! 😀 Well it’s nice to know someone who really follows my blog. Hihi. I now feel like a newbie having all of these stocks while the “expert” only has a few but totaling P1M. 😉 Haha. I would say it’s also because I’m trying to understand still how the market works. Eventually, I also plan to only acquire companies that I truly believe in and are aligned with my values. Call it a real sense of ownership. 🙂

How did you select the few companies in your portfolio?

LikeLike

I may not leave a comment on all your posts or drop by every single week but when I get da chance I do read your blog same as the other blogs that I follow like Budgets are Sexy & Financial Samurai. Its nice to know that people I dont know shares the same passion as me because I can count in ONE HAND my friends that are saving & investing so in my world it’s kinda rare. I actually started with 25 stocks at da beginning haha but then I realized as time progresses that you only need ownership of da super stable companies. I also have “play accounts” wherein I actively trade wherein I can go crazy & buy any stocks I want then sell them the next day or week for profit. How did I chose my stocks? I checked their balance sheets LOL.

LikeLiked by 1 person

[…] Maven of I The Corporate Slave shared her first COL portfolio last month and her 25,000php is scattered to more than 10 different stocks! A-MAZ-ING! […]

LikeLiked by 1 person

Hi Maven,

Just found your blog thru random search.

I wonder if you already trim down your portfolio given the previous PSEi all time highs.

I also did that having a fully diversified portfolio when I started stock market investing.But right now,I’m just holding maximum of 5 stocks.(blue chip averaging for long term and penny stock for trading).

By the way,nice blog…..

LikeLiked by 1 person

Thanks, Christian! 🙂 Glad you bumped into my blog!

Unfortunately, although the PSEi has been soaring lately, the stocks I have are still on the red. 😐 Since they’re small value anyway, I’m trying to discipline myself to stick with it until I get a chance to sell them on the green. But the opportunity to buy other good stocks are so tempting!

Anyway, I’m still going for trimming them down like what you said through better understanding of what I actually want to invest in. 😉

Keep in touch!

LikeLike

[…] a look at this first COL investment portfolio from Maven of I The Corporate […]

LikeLike

Hi Maven,

Just so happened that I got into your blog by doing research. I’m a newbie in investing and I would appreciate if by any chance can you explain what’s in the weekly note i.e. PSEi level of 8,000 and why is it the last opportunity to buy below 8,100? Thanks!

LikeLike

Hi JLC! Glad you chanced upon my blog. ☺️ I honestly haven’t read the latest COL weekly note, but it does seem that the index is quite bullish lately. To simplify, the PSEI level of 8000 is a sort of average price of the biggest listed companies in the Philippines and is used by analysts as a representation on how the market is doing.

In saying that this is the last opportunity to buy below 8,100, COL is suggesting that the index may continue to rise and sustain this price for good. Meaning if you don’t buy now, most of the stocks will be more expensive soon.

A word of caution though that COL analysts are professionals who spend their time studying the market, but that doesn’t mean what they say is conclusive. 🙂 In the end, something that they have not factored in their analysis might happen, and the index could also go lower.

Sorry for the lengthy reply! 😅 I suggest you also do your own research, or if you’re like me who do not have much time for that, just invest in low-cost index funds like XALSIF (it’s also available through COL). Just start investing now, add to it regularly, and sit back and watch your investment as it grows with the market. 😉

Good luck and feel free to ask further if you have other clarifications!

LikeLike