Welcome Q4! Yes, it’s the last quarter of the year and we’re nearing the final stretch! Finally some good news this month with my finances bouncing back up. Without further ado, here’s my net worth for the first of October.

The Balance

The Breakdown

Deposit Accounts. I won’t deny that cash has been real tough these past few months. I only realized last month when I got my salary that I’m actually barely making it in terms of cash flow! You can see that I left most of my cash in my checking account and this is because they are for paying obligations due before the next payday! That means, technically, I only have a few thousand to spend until then. And to be honest, I’m only managing through credit card debt. 😐

Investments. Thank the bull run in the stock market these past weeks! Have you heard the PSEi has reached an all-time high of 8,294.14 last Sept. 18? Wow, it does feel good now that the August ghost month has ended. I hope some of you have started your own stock portfolio and are riding the market gains too!

Aside from the Philippine stocks-related gains, my other investments are steadily growing thanks to salary deduction and post-dated checks. Hehe. There’s no missing these!

Payables. One other good thing for this month is the continued decline in my liabilities. There are no one-offs for the month (well maybe some related to my birthday expenses :D) and my credit card bills I would say are on a normal level. My installment bills are continuing to get paid as well.

Overall, I would say that Php30k+ of the improvement came from my usual investments while Php10k+ was from paying my debts. Yes, paying your debts increases your net worth, dear!

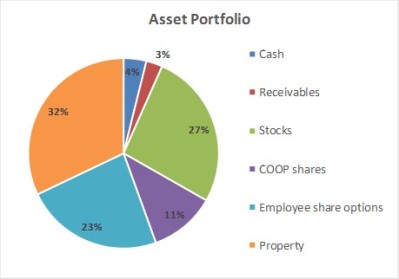

Btw, I have also made a simple pie chart to see how my asset portfolio looks like:

Cash at 4%?!? Hahaha. Am I that scared with losing my money’s value due to inflation? Well no. Cash is just really tight lately. I should work on building this up somehow to have a good level of emergency funds again.

I’m still glad my receivables are minimal now.

A good chunk of my assets are in PH stocks which I think is great with the recent uptrend in the market. My COOP shares and employee share options are employer-related investments I’m glad I took part of and are now making up 1/3 of my portfolio.

And finally, another 1/3 of my assets is in property! Wow, how time flies by since the day I decided to get myself a condo unit. I just recently visited the property again with my family. Still mulling over if I should sell it once it’s been turned over or should I push through with having it rented out? My unease in the property market is due to rumors that there’s already a property bubble and that to be honest, one thing that is usually lacking in the Philippine scenario is reliable statistics that will tell you how much is the real market value of your property. You never know until you’re finally faced with the possibility of selling your property!

Anyway, there’s still a bit of time to make a decision. And it might still be good to at least have some diversification in the asset types I hold. Maybe if I find some other venue to put it in then that may force me to change portfolio. Let’s see in the coming months!

Hey! I really do hope you guys are doing well. It’s been tough to update the blog lately with new changes again in my life. But hope to bounce back soon – like my finances this month!

I can totally relate with being currently cash-strapped, but with the upcoming bonuses and my installment payments ending soon, this will soon be a thing of the past! Konting tiis na lang.

LikeLiked by 1 person

Yes! Same na same scenario here. Looking forward to November so I can replenish my emergency fund as well. Kapit lang! 😉

LikeLike

Hi Maven! I just recently discovered your blog and I must say I had a really good time reading your content. Just wondering, in computing net worth, isn’t it proper to include any personal properties such as gadgets, jewelries, etc. in computing assets? 🙂

LikeLiked by 1 person

Hi Sleepy Sir! 🙂 Glad you’ve dropped by! Personally, I don’t want to put in gadgets since I believe they depreciate quite quickly and it’s hard to really track their current value. Also, I use them for day-to-day and do not really plan to sell them eventually. Same logic I guess with furniture and appliances.

Jewelry I think is more acceptable to be included especially if it is gold which has more generally accepted standard prices/values.

But there is really no definitive rule which ones to include or exclude in a personal net worth. It would depend on you and what you think you value amongst everything you own. 😉

LikeLiked by 1 person